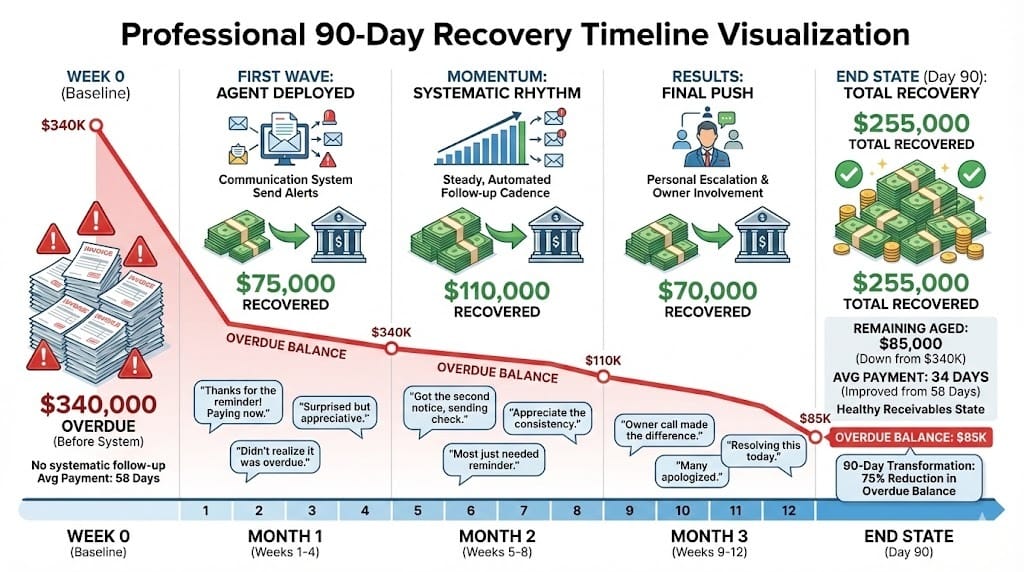

TL;DR: An industrial cleaning company in Detroit had $340K sitting in receivables over 60 days. Average days to payment was 58—nearly double their Net 30 terms. The problem wasn't bad customers. It was that nobody was systematically following up. We built an agent that monitors receivables daily, sends tiered follow-up communications, and escalates when human touch is needed. Average payment dropped to 34 days. Over-60-day receivables fell to $85K. Most customers just needed a reminder.

The Aging Report Horror

Marcus pulled the AR aging report on a Thursday afternoon. He'd been avoiding it.

$340,000 over 60 days. $180,000 over 90 days.

This wasn't a collections problem. This was a cash flow crisis hiding in plain sight.

His industrial cleaning company was doing fine by most measures. 52 employees. Contracts ranging from $2K to $50K monthly. Manufacturing plants, commercial facilities, steady work across Wayne, Oakland, and Macomb counties.

But the money wasn't coming in.

Net 30 terms. Average actual payment: 58 days. Some invoices sitting at 120 days. A few at 180.

"We're essentially financing our customers' cash flow," Marcus said. "Except we didn't agree to that."

Why Nobody Was Calling

Here's the uncomfortable truth about collections at most small businesses: nobody wants to do it.

The office manager doesn't want to be the person who nags clients. The owner is busy running operations. The bookkeeper sends invoices but considers follow-up outside their role.

So it becomes a thing that happens "when there's time." Quarterly, maybe. When cash gets tight enough that someone finally sits down with the aging report.

Marcus had tried assigning collections to his office manager. She lasted two weeks before the awkwardness overwhelmed her. "I can't call these people every day. They're our clients."

He tried doing it himself. Made a list of overdue accounts, started calling, got pulled into an emergency at one of the plants, never finished the list. The list sat on his desk until the next crisis made him look at AR again.

Nobody wanted to be the collections person. So nobody was.

The customers weren't trying to stiff them. Most of them had just... forgotten. Or deprioritized. Or the invoice was sitting in someone's inbox waiting for approval that never came.

The companies that got paid on time were the ones that asked. Professionally. Consistently. That's all it took.

The Real Cost

Let's be specific about what $340K in aging receivables actually costs.

Opportunity cost: That $340K isn't earning interest. It isn't funding growth. It isn't covering payroll without a credit line.

Borrowing cost: Marcus had a $150K line of credit he tapped regularly to cover the gap between receivables and payables. Interest: 8.5%. That's real money leaving the business because customers weren't paying on time.

Write-off risk: The longer an invoice ages, the less likely it gets paid. Industry average: 10% of invoices over 90 days eventually get written off. That's $18K of Marcus's $180K that might never arrive.

Mental overhead: The anxiety of knowing money is out there but not knowing when—or if—it's coming back.

For more on how to calculate what bottlenecks like this actually cost, we've built a framework here.

What We Built

The collections follow-up agent has five stages.

Stage 1: Receivables Monitoring

Daily scan of QuickBooks for all open invoices. Tracks days since invoice date. No more quarterly "oh no" moments looking at an aging report. The agent knows exactly what's outstanding, every day.

Stage 2: Communication Tiering

Not every overdue invoice gets the same treatment. The agent follows a tiered approach:

Day 25: Friendly reminder. "Just a heads up, Invoice #1234 is coming due in 5 days."

Day 35: Professional follow-up. "Invoice #1234 is now 5 days past due. Please let us know if there are any issues."

Day 45: Firm reminder. "This is a second notice regarding Invoice #1234, now 15 days past due."

Day 60: Escalation warning. "Invoice #1234 is significantly past due. Please contact us immediately to resolve."

Day 75+: Owner alert. Human touch required.

The tone escalates gradually. Professional persistence, not aggressive harassment.

Stage 3: Customer Intelligence

Before sending any communication, the agent checks context. Has this customer paid late before? Is there a pattern? Are there notes about a dispute or issue with the service?

A first-time late payer gets the benefit of the doubt. A serial late payer gets firmer language sooner. A customer with a logged dispute gets flagged for human review before any automated follow-up.

Stage 4: Communication Generation

Drafts the appropriate email based on tier and customer history. The agent writes in the company's voice—professional, direct, not robotic.

Example Day 35 email:

"Hi Janet, I wanted to follow up on Invoice #4521 for the October facility cleaning at your Warren location. The invoice was due on the 15th and is now 5 days past due. If you've already sent payment, please disregard—and thank you. If there's anything holding things up on your end, let me know and I'm happy to help sort it out."

That's not a collections letter. That's a human email. It just happens to be generated and sent systematically.

Stage 5: Tracking and Escalation

Every communication gets logged. Responses get tracked. If a customer replies, the agent flags it for human follow-up rather than continuing the automated sequence.

The owner gets a weekly summary: total AR, aging breakdown, communications sent, escalations requiring attention, and any wins (payments received after follow-up).

The Human Checkpoint

The agent doesn't make collection decisions. It makes collection communications.

Escalations over Day 75 go to Marcus for personal outreach. Disputes get flagged immediately for human resolution. Any customer who replies with a question or concern gets routed to a person.

The agent handles the volume. The human handles the judgment.

What We Learned Building It

Tone was harder than timing. The technical part—scanning QuickBooks, tracking days, sending emails—was straightforward. Getting the email language right took multiple rounds of revision. Too stiff sounded like a collections agency. Too casual sounded unprofessional. We ended up with Marcus reviewing and editing the first dozen or so templates until they sounded like emails he'd actually send.

Dispute detection needed training. The agent needed to recognize when a customer's reply indicated a dispute versus just a question. "When was this invoice sent?" is different from "We never received this service." Early versions missed some of these signals.

The first week was awkward. Customers who hadn't heard from the company in months suddenly got follow-up emails. A few called confused. One was annoyed. Most appreciated it. After the initial wave, things normalized.

The Numbers

Before:

58-day average payment (Net 30 terms)

$340K in receivables over 60 days

$180K over 90 days

No systematic follow-up process

After:

34-day average payment

$85K over 60 days

$45K over 90 days

$255K recovered in the first 90 days

The surprise: Most customers apologized.

They'd lost track. The invoice was buried. Accounting had a backlog. They appreciated the professional reminder.

One customer's AP manager told Marcus: "Thanks for following up. You're the only vendor who actually does. Everyone else just lets things slide and then gets angry."

Professional persistence works. It just has to happen.

The Pattern

If you've got receivables that consistently age past terms, you probably have a collections process problem—not a bad customer problem.

The symptoms:

Average days to payment significantly exceeds your terms

Aging report surprises you every time you look at it

Nobody "owns" collections in your organization

You've tried assigning follow-up but it never sticks

The core issue: Follow-up feels awkward and gets deprioritized. So it doesn't happen.

The fix isn't about being aggressive. It's about being systematic.

Next Steps

Want to see how this connects to invoicing? The invoice processing blueprint shows what happens upstream—getting invoices out faster so the clock starts sooner.

Want to see 25 agent architectures across different industries? Download Unstuck—it includes this one plus blueprints for lead gen, scheduling, quoting, and more.

Think receivables might be your bottleneck? Book a Bottleneck Audit. 30 minutes, no pitch. We'll map your current AR process and identify where the delays actually live.

by WB

for the AdAI Ed. Team